One payment method for all cases: The return of the direct debit

Direct debit is old hat, you might think. But if you look at current statistics, this payment method is in greater demand than ever before. Dr Jörg Seelmann-Eggebert, industry visionary and CSO of FinTech and White Label BNPL enabler axytos, explains why and how direct debit can be raised to a new level through protection.

One payment method for all cases

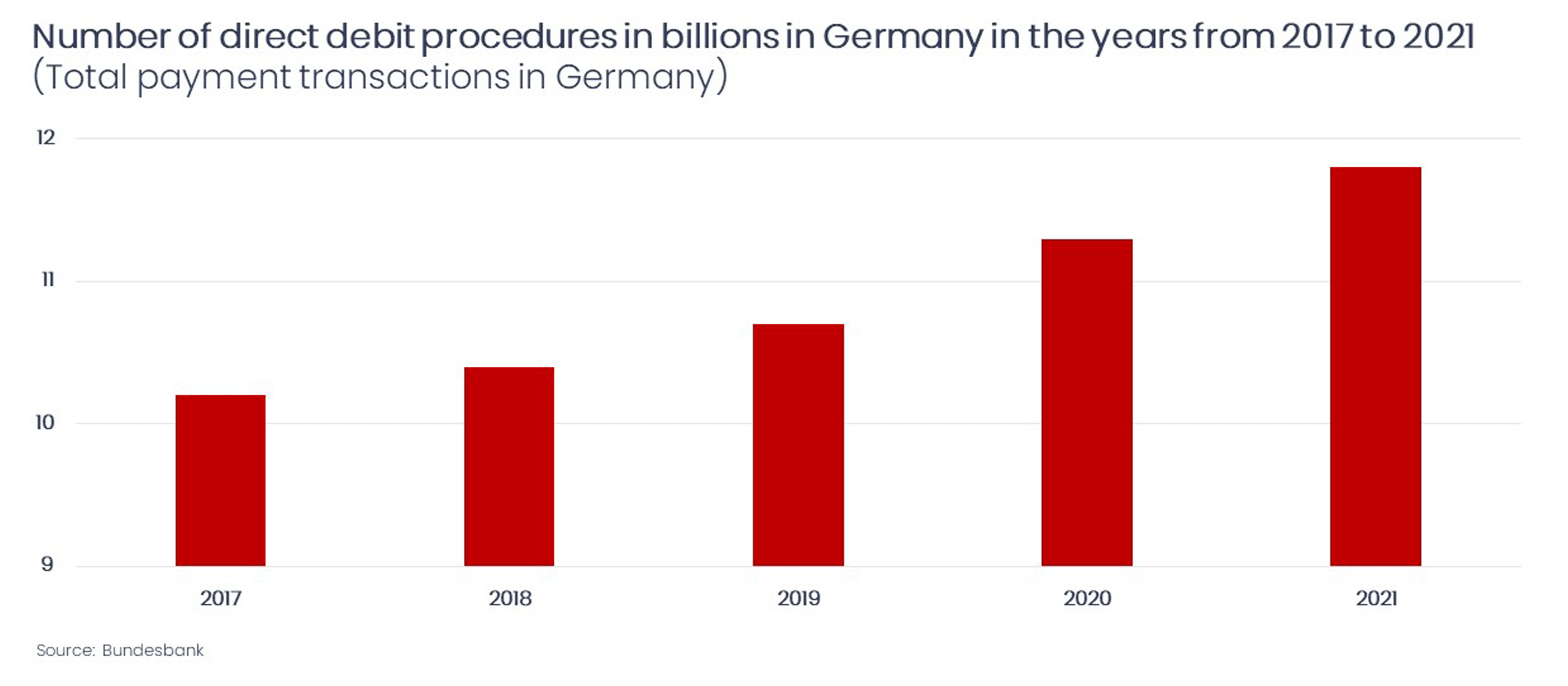

The SEPA Direct Debit (Single Euro Payments Area), which is recognised throughout the European payment area, has been in existence since 2009. In 2021, almost 11.8 billion cashless payment transactions were carried out by SEPA Direct Debit in Germany. The SEPA Direct Debit Scheme is particularly useful when it comes to regular payments, even with different payment amounts. These can be subscriptions to streaming services, the gym, the monthly electricity bill, insurance or club fees and much more. Not so well known is the fact that payments by Girocard in stationary trade are also direct debits. The strong increase in this payment method in e-commerce is relatively recent, and we will look at the reasons for this in more detail later. But telecommunication companies are also rediscovering the direct debit: in order to make its products as easy as possible to bill, a large German company has recently started using the intelligent, payment-guaranteed direct debit procedure from axytos.

axytos CSO Dr Jörg Seelmann-Eggebert: “Direct debit is anything but old hat. It is an important payment method for merchants and extremely convenient for buyers.”

The direct debit procedure: The high acceptance leads to a gigantic volume, with an upward trend – increasingly also in e-commerce.

The direct debit procedure: known, accepted and used with pleasure

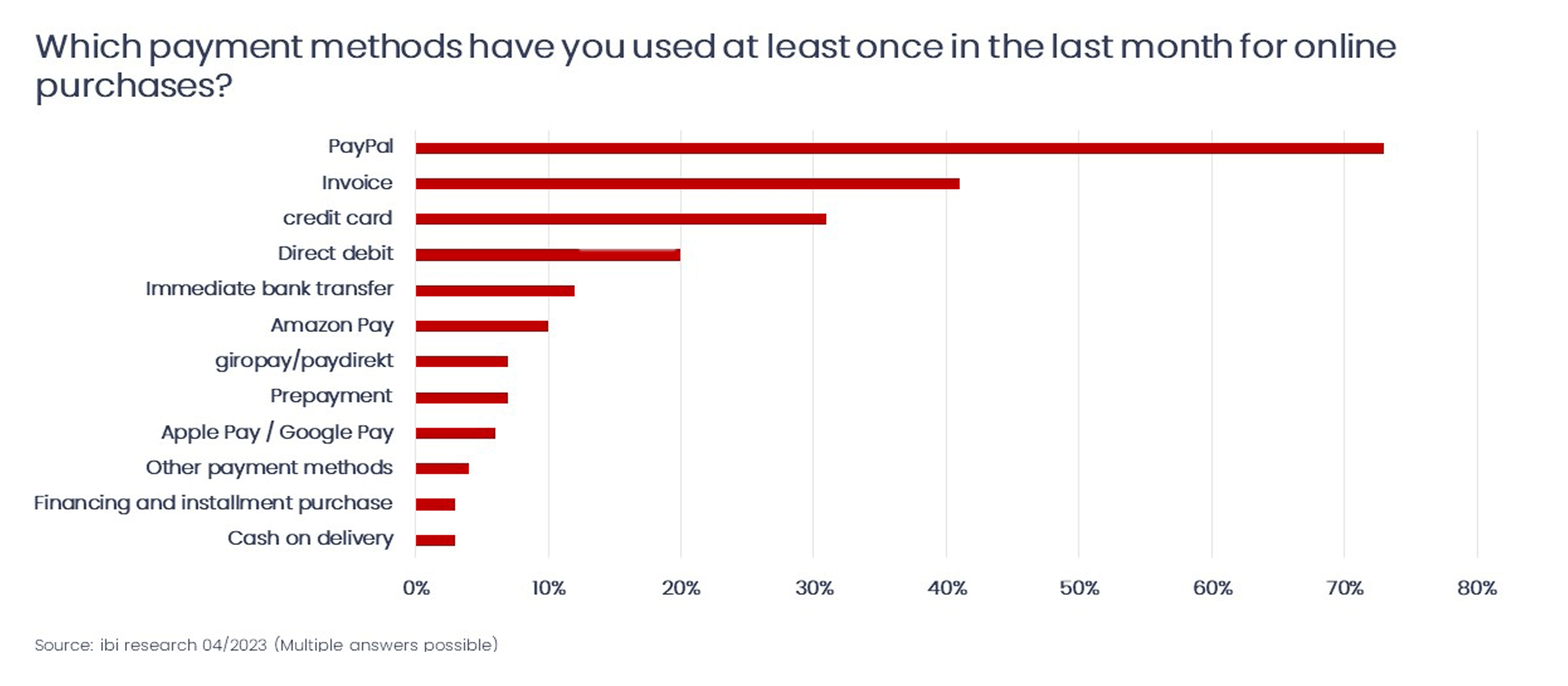

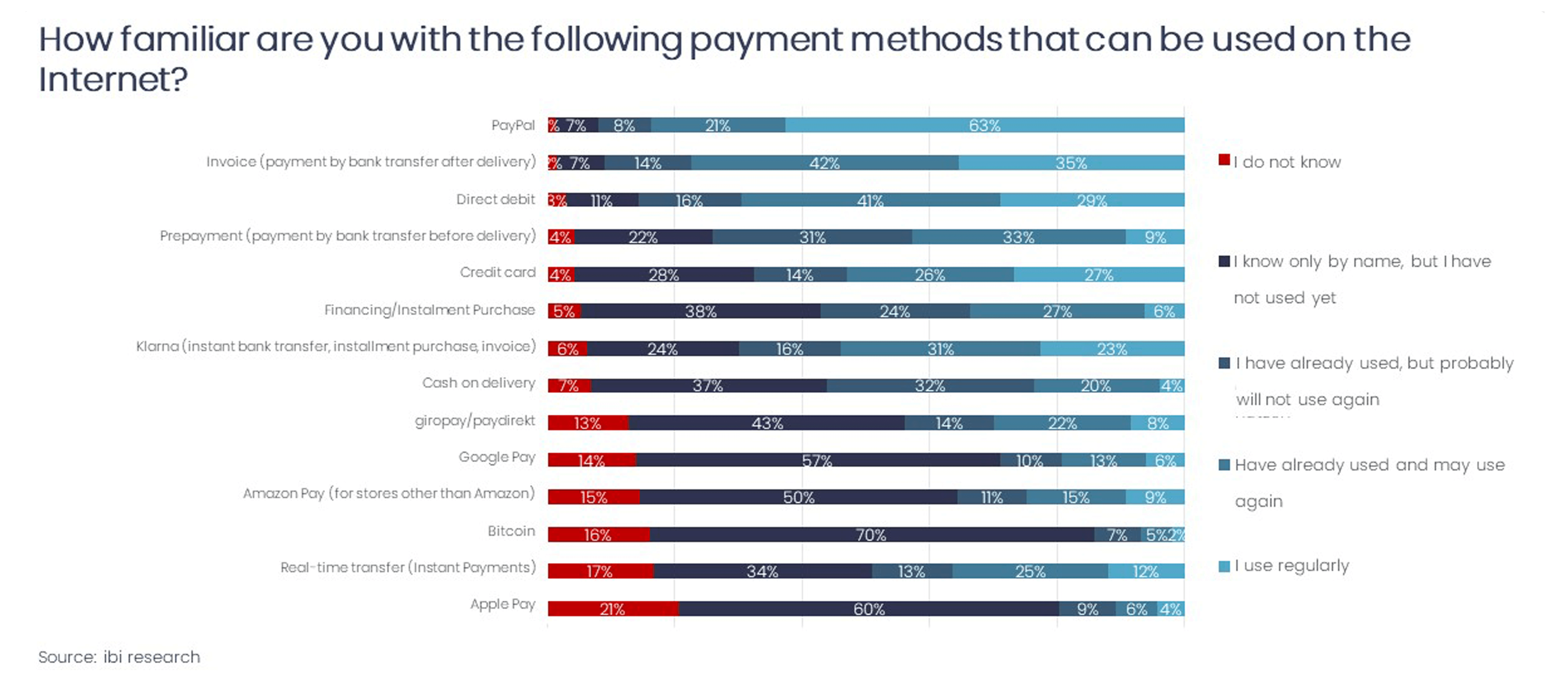

According to a recent survey by ibi research from April 2023, direct debit is in fourth place in the question “Which payment method have you used at least once in the last month for online purchases? Important here: PayPal is also often a redirected direct debit in principle, as the payment amount is ultimately usually collected from the account. In response to the question “How familiar are you with the following payment methods used on the internet?”, direct debit is even in third place, just behind PayPal and purchase on account: a total of 70 per cent of respondents stated that they regularly use direct debit, have already used it and will possibly use it again.

The figures from the current survey by ibi research allow no other conclusion: direct debit is more relevant than ever.

Many advantages and one small catch

The advantages of direct debit are manifold: once the IBAN of the buyer has been stored, one-click payment is possible, as for example with Amazon. This makes the payment method extremely conve-nient and increases customer loyalty. For retailers, direct debit is also cheaper than other payment methods. Especially when intermediaries like PayPal are once again cutting costs. In addition, direct debit is very easy to integrate into the webshop and the IT infrastructure of the retailer. The buyer always remains in the online shop’s system at the checkout and is not transferred to an external payment service provider, which can often lead to a purchase being cancelled at the last minute. In this way, the customer relationship is maintained at all times.

This is where it gets particularly exciting: payment processing via direct debit is fast and includes numerous control options. The merchant can set parameters such as the debit date himself, thus adjusting to the needs of the buyer and also informing him in a fully automated follow-up process. This means that they can stay in contact with their customers at all times without any great effort. They can offer them individual direct debit models such as hire purchase or part payment, or products such as printer paper on a subscription basis, depending on the business model.

The accounting department is also happy about the direct debit procedure, because the assignment problems with bank transfers are eliminated: no more cryptic information and creative booking texts have to be decoded. No more tedious searching in the records when the mother pays for the son (or vice versa).

However, one disadvantage of the direct debit procedure should not be concealed here: the return debit note in the case of insufficient funds or fraud. But there is a solution to this too, as we will see in a moment. It is reassuring to know for direct debit users: From a purely legal point of view, a return debit note is a self-reminder, the buyer is in default immediately and without further action. The situation is therefore crystal clear and identification and allocation is also extremely simple, as all information is reported back in an automatic process.

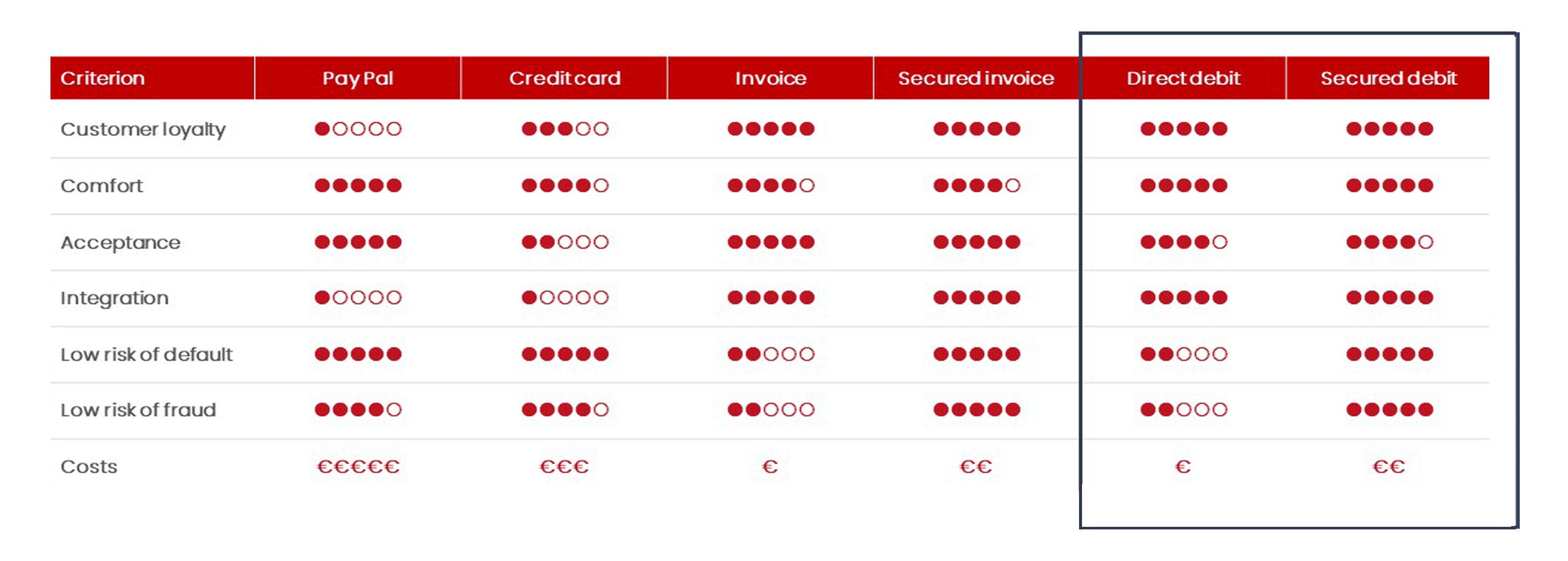

The advantages of direct debit at a glance. Similar to the secured purchase on account, the secured direct debit procedure is superior to the other payment methods in all areas.

The optimal solution: the secured white label direct debit procedure

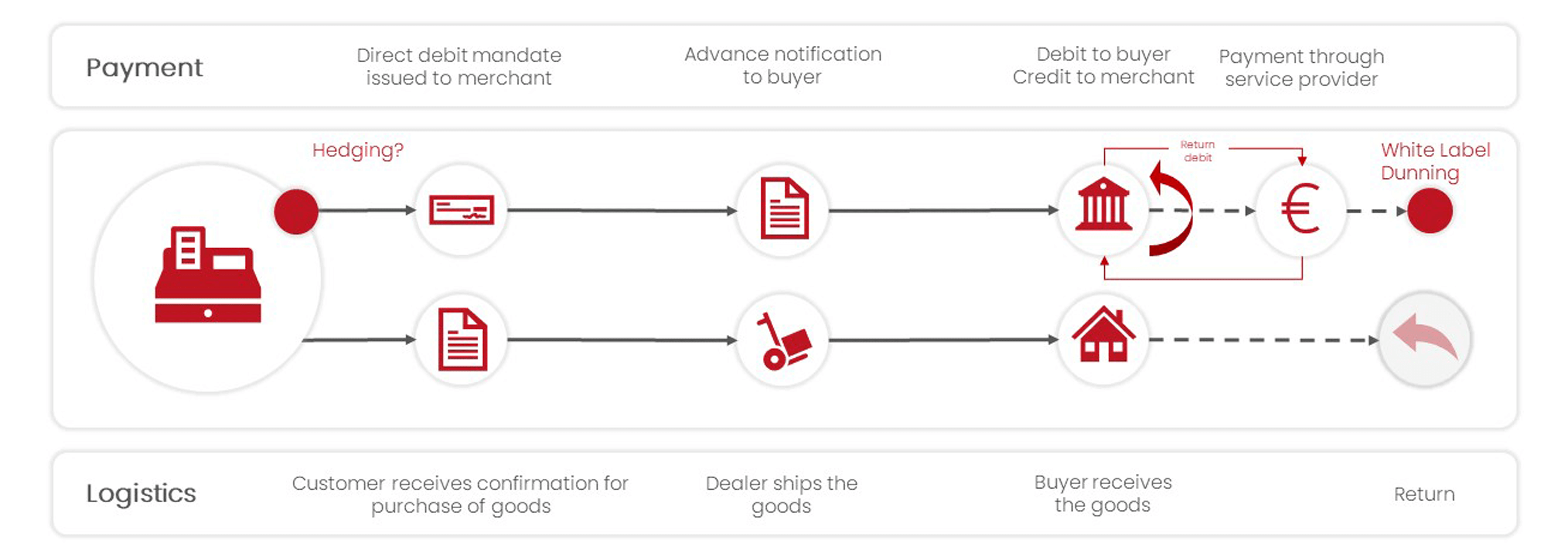

With direct debit, the payment process is decoupled from the logistics, in contrast to credit card payment, for example, where the payment must first be confirmed by the credit card provider before the goods can be shipped. This also has the advantage that control and communication run in parallel and the retailer can inform the buyer about the progress of his order at any time. The API-based cloud platform of the white label BNPL enabler axytos reduces the probability of a later chargeback with a credit check directly in the checkout. If a chargeback does occur, axytos pays the secured direct debit to the merchant’s bank account and takes over the dunning process in the white label. This means that the buyer is not contacted by an external service provider, but always remains in direct contact with the merchant.

The secured direct debit of the white label BNPL enabler axytos: Best of both worlds for buyers and merchants.

Conclusion: Direct debit is anything but old hat. It is an important payment method for merchants and extremely convenient for buyers. By offering the payment method as a white label, customer loyalty and conversion rates increase, and the further developed, secured direct debit procedure of the white label BNPL enabler axytos also makes the risks manageable and controllable.

Share:

Subscribe to axytos News now and always be the first to know.

Share: